In recognition that the brewing (and other alcohol manufacturing) industry is being “severely impacted” by COVID-19, the United States Alcohol and Tobacco Tax and Trade Bureau (TTB) issued a new Industry Circular (No. 2020-2) on March 31, 2020. This Circular postpones several filing and payment due dates by 90 days, providing welcome relief to brewers during the current pandemic and economic downturn.

Of note, where the original due date falls between March 1, 2020 and July 1, 2020, those due dates are now postponed for 90 days for a number of important matters, including the following:

In addition, TTB announced that it will be considering emergency variations from regulatory requirements for affected businesses on a “case-by-case basis” and will be reviewing requests for relief from penalties based on “reasonable cause.”

Excise Taxes and Returns

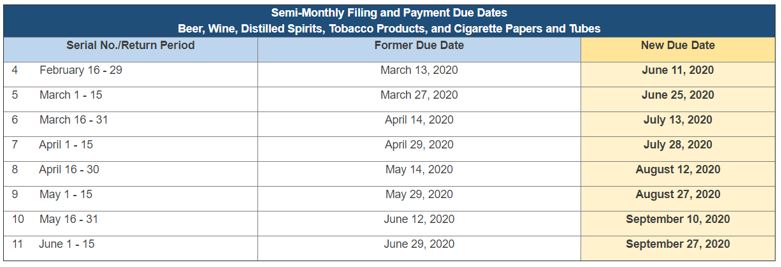

With respect to the postponement of the payment of excise taxes and filing of excise tax returns, interest and penalties will not accrue so long as the payment is made, and the return is filed within 90 days of the normal due date(s). For quarterly filers, the due date for the first quarter (Jan. 1 – March 31) has been postponed from April 15, 2020 to July 14, 2020. For semi-monthly filers, the new due dates are as follows:

The Circular applies only to excise taxes and does not postpone the payment of any other type of federal tax that may be due.

Operational Reports

For operational reports (normally filed monthly, quarterly or annually, depending on production), the due dates for submissions have also been postponed 90 days, as follows:

Credits and Refunds

Generally, claims for credits or refunds for excise taxes paid on alcohol products returned to the manufacturer must be filed within six months. The Circular now postpones that time limitation by 90 days, such that any claim that would ordinarily be required to be filed between March 1, 2020 and July 1, 2020 can now be filed within 90 days of the original due date and still be considered timely. To avoid delays, industry members are “strongly encouraged” to file such claims electronically through TTB’s new online submission form, which can be found here. TTB will continue to process any filed claims as they are received.

Other Regulatory Relief

In its Circular, TTB recognizes that many regulated industry members may be impacted by COVID-19 in ways not addressed by the Circular. Consequently, the Circular also announces that TTB will consider applications for the use of “reasonable alternate methods and procedures” in lieu of normally applicable regulatory requirements to “help … affected industry members … resume or continue their operations.” Such application will be considered on a case-by-case basis. In addition, TTB will consider requests for relief from penalties that may be accessed for missing payment or filing deadlines if such requests are supported by “reasonable cause” (this term is not further explained in the Circular). While certain due dates have been pushed back to help affected businesses, it is important to know which payments and reports this applies to and which you are still required to make in a timely manner.