It’s an exciting time, after dreaming about it for years and pre-planning, you’re finally going to open that brewery you’ve been wanting. Then the fun begins and money starts going out. You’re now dealing with lawyers, landlords, brewery licensing and equipment, TTB, and insurance… fun fun fun.

You ask some colleagues who they use for this and that, you get referrals and you also have some of your own resources. Some of these items are pretty straight forward and some a little more complex, which brings me to my term “Frankenstein-ed”.

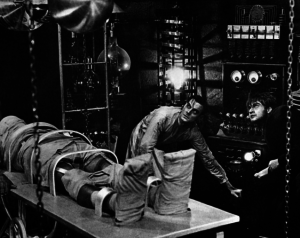

First, let’s get into who Dr. Frankenstein was and what he did.

Dr. Frankenstein was a fictional character that tried to create a human by piecing different cadaver parts together and then bringing it to life by having the body struck by lightning… the end result was a monster.

You with me so far? Good!

What if I was to tell you that a kind of Frankenstein monster can exist in real life?

Well, it can and it does in the form of some brewery insurance policies. Hopefully not yours.

There are some carriers that have bonafide insurance packages that they created from the ground up for breweries and distilleries. Those are the only package policies that you should consider, and for good reason as they were created to help eliminate holes in the “Frankenstein-ed” policies.

You wouldn’t intentionally insure your car on a motorcycle policy, right? So why would you insure your brewery or distillery with a restaurant policy? You wouldn’t, but you may be without knowing it.

Insurance brokers that specialize in this space learn all of the nuances associated with your unique risks. I use the term unique because that’s exactly what they are.

Many of the incorrectly written policies are pieced-together restaurant policies that would only cover a business with up to 70% of their sales coming from alcohol.

If you have a straight up brewery or distillery, odds are that almost 100% of your sales come from alcohol. This creates a big problem if a claim was to occur and you didn’t have the proper policy.

Some tips to avoid being “Frankensteined” are:

Your insurance coverage is important so make sure you’re properly protected… and not a Frankenstein Monster.