The following Guidelines apply to Distilled and Fermented Beverage Export Loan Initiative:

Applicant Eligibility Criteria

- For-profit small- and medium-sized businesses must be located in New York State and:

- Must have 500 or fewer employees in New York State

- Be licensed by the NYS Liquor Authority to produce beer, wine, spirits, or cider

- Intend to begin exporting or expand export sales in foreign markets

- At least one of the following:

- 51% of the value of finished product or service originates in New York, the calculation of which includes the value of the raw materials and component parts, manufacturing process, advertising and promotion, distribution, warehousing, and designs and other intellectual property, or

- A business that is certified as a local producer through a regional Chamber of Commerce or Economic Development Agency (e.g., Made in NY; Made in Brooklyn)

- Business is viable and in existence for at least two years by the date of application for the Global NY Loan Fund

- Demonstrated need for loan assistance

- Applicant has demonstrated understanding of costs associated with exporting and doing business with foreign buyers, including costs of freight forwarding, customs brokers, packing, shipping, marketing, etc. Applicant will be asked to provide an “Export Readiness Score” by completing the U.S. Department of Commerce’s Export Assessment available on-line at https://new.export.gov/export-readiness-assessment/login

Eligible Use of Funds

Loan Proceeds may be used to develop export capacity, enter new export markets and/or expand sales in existing foreign markets. The purpose is to increase New York State’s competitiveness in the global economy, while retaining and creating jobs in New York. Costs cannot be incurred prior to ESD approval of the loan.

Eligible uses may include, but are not limited to, the following:

- Market Customization including translation of web/printed materials for a targeted foreign market, design services, international marketing/advertising in a foreign market, etc.;

- Product Adaptation and Market Certification to enable eligible businesses to enter a foreign market successfully, including modifying a product line to conform to mandatory foreign government regulations, geographic conditions, buyer preferences, product labeling and packaging, and other export requirements. This category is limited to those issues that are considered to be required in order to export; and

- Enhancement of Export Capability including, among other things, developing export marketing plans, website translation, product adaptation, and obtaining market certification.

- Machinery & Equipment to facilitate the production of products targeted to a foreign market.

Ineligible Use of Funds

Ineligible uses of loan proceeds include, but are not limited to:

- Costs incurred prior to receipt of the ESD incentive proposal/award notification

- Utility costs, taxes, debt, or insurance premiums

- Personnel expenses

- Administration of loan proceeds

- Legal services

- Meals, passports, visas, or immunizations related to trade events or international travel

- Expenses related to entertaining current or potential clients or government officials

- Standard business supplies

- Business Class or First Class airline tickets

Loan Requirements

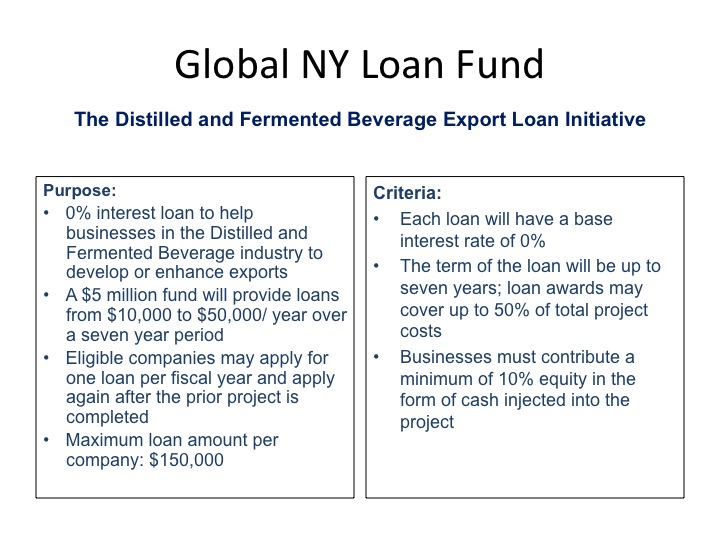

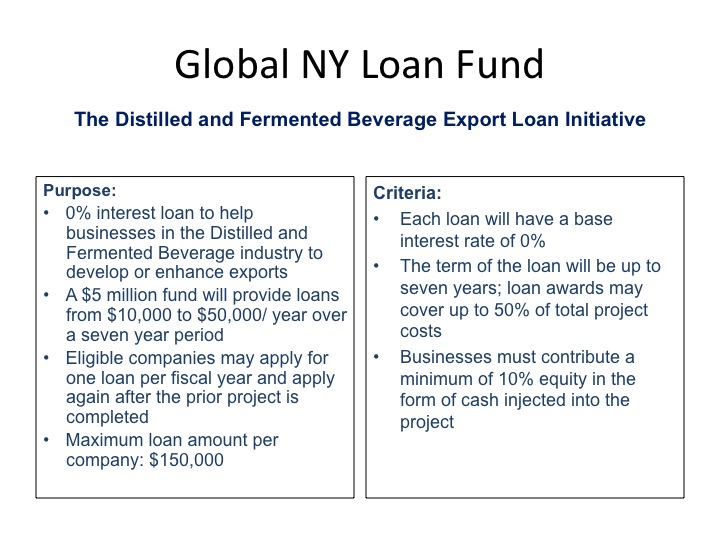

The maximum principal amount of each loan shall not exceed $50,000 or be less than $10,000. Applicants are limited to one loan per State fiscal year. Subsequent awards are contingent on successful documentation and completion of the prior loan. Each loan will have a base interest rate of 0%, but a higher rate may apply if the loan is not repaid on time. The term of the loan will be for up to seven years. Loan awards may cover up to 50% of total project costs. Businesses must contribute a minimum of 10% equity in the form of cash injected into the project, which should be auditable through financial statements or accounts, if so requested. Other state and federal grant funds may not be including in project costs. Applicants must provide documentation of sources and uses of funds, and must provide proof of payment and receipts related to the eligible expenses.

A single loan may cover more than one eligible activity at a time (applicants may bundle eligible activities), however, all applications will be reviewed and approved on a case by case basis. No single Applicant can receive more than $50,000 in loan funding per State fiscal year or $150,000 in total loans over the course of the 7-year program.

If there are any changes to the proposed/approved items to be funded with the loan, then the Applicant must notify ESD in writing about the changes immediately. If the change affects the line item budget by 10% or less, then the applicant and ESD must discuss and agree to the changes. If the change affects the budget by more than 10%, then ESD reserves the right to reevaluate the project and may rescind the award.

Application Requirements

An applicant must file a completed application, which includes, but is not limited to:

- complete application with original signature and all attachments including an attestation that the business or organization is compliant with tax obligations and all relevant environmental, labor, and operating laws;

- certificate of incorporation other form of evidence or the ability of the applicant to conduct business in the State of New York;

- narrative (not to exceed two pages) explaining your export plan/strategy, plus a complete project budget with sources and uses of funds, project work plan, and demonstrated fulfillment of New York State production content criteria or;

- detailed description of sources and uses of funds;

- demonstration of financial need, including two most recent tax returns or financial statements and attestation that, but for the loan, the project would not take place;

- documentation of project costs including detailed specifications, scope of services and associated quotes;

- an agreement to submit a Project Impact Report after completing activities funded with the loan and to participate in ESD surveys about the results derived from the activity, funded with the loan, after the fact.

ESD may require additional or alternative documentation as deemed necessary.

Application Review

Complete applications that meet the Application Requirements and the $10,000 minimum loan threshold will be accepted on a rolling basis, but they will be reviewed and approved every other month in-line with the State’s fiscal year (April – March), based on, but not limited to, the following criteria:

- Eligibility

- Promotion of economic vitality of New York State by facilitating the creation or retention of jobs or increasing business activity through exporting

- Project is reasonably likely to accomplish its stated objectives

- Likely benefits of the project exceed costs

- During the last fiscal year, business must have had at least $250,000 in net sales, a positive EBITDA (Earnings before interest, tax, depreciation and amortization), and current ratio and current assets to loan amount ratio of 1:1 or greater

- Evidence of a contribution of at least the minimum cash equity

- Corporate and/or personal guaranty may be requested.

Pursuant to these guidelines, ESD has the right to review and approve or reject applications in the exercise of its discretion.

Methods of Disbursement

The final disbursement of loan funds will not be made until the project is complete and all supporting documentation is received within 60 days of project completion. Prior to disbursement of loan funds, the following information must be submitted:

- A project participation report including documentation of project completion, such as photographs, marketing materials, and measurements of success;

- invoices and associated paid receipts including, but not limited to, cleared checks, register receipts and credit card receipts;

- other supporting documentation as may be necessary to verify successful project completion and payment of eligible costs;

A Project Impact Report including information on project outcomes, such as export sale

Questions? Please Contact:

Ms. Huey-Min Chuang

Senior Director of Business and Economic Development

Empire State Development

633 Third Avenue, New York, NY 10017

Huey-Min.Chuang@esd.ny.gov | www.esd.ny.gov